Step One

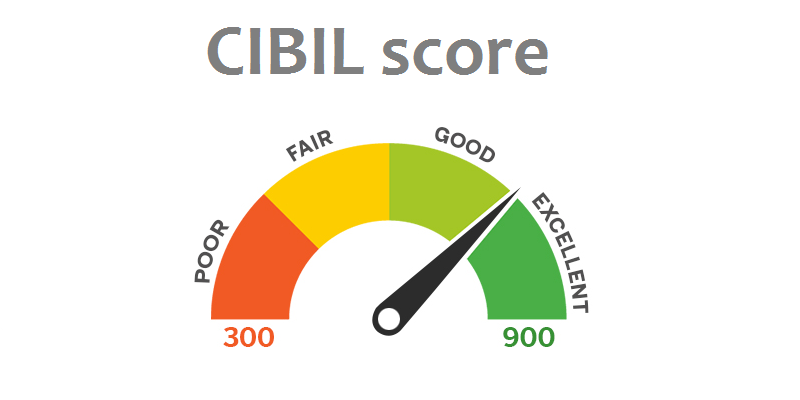

You will be required to provide us with your credit reports from all four credit bureaus, Cibil, Equifax, Experian, and CRIF High Mark. If you want we can help you to pull all the credit bureaus report. Most of them offer free credit reports once every year or you can pull by paying the minimum amount for your reports.

Step Two

Second, we provide you with a deep analysis of your credit report spotting all inaccurate information. We then look at the various factors that are pulling your credit score down and provide you with actionable steps to get your score back up. Lastly, we provide you with step-by-step guidance on how to rebuild and restore your credit. We focus on fixing your credit from start to finish. Our goal is to help consumers with bad credit through our restoration program.

Step Three

Third, we load all of the inaccurate, misleading, and unverifiable information into our system, and begin challenging questionable information with the credit bureau, creditors, and collectors. Now, that you have indicated questionable entries on your credit report, it’s our turn to launch the dispute process on your behalf. Guideline Cibil Score initiates credit report repair strategies to challenge questionable items directly with the credit bureaus and creditors.